Half of the families live on less than a thousand euros per month

- admin

- November 2, 2015

Deco study reveals that 18% can not afford providing the house and water bills, electricity and gas

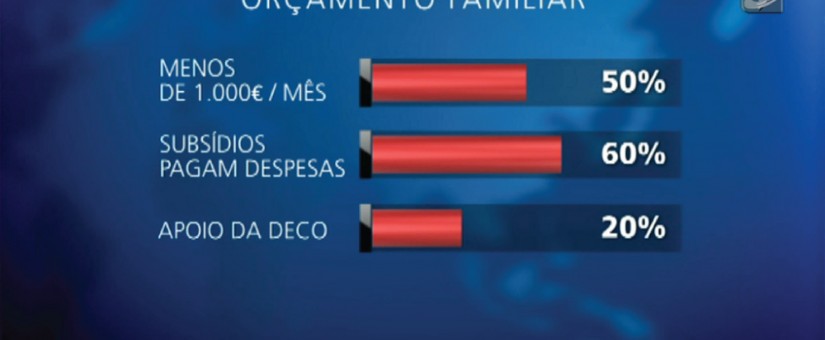

Half of Portuguese families with children survive on less than a thousand euros per month and 18% can not afford to provide the house and water bills, electricity and gas, according to a study by DECO.

According to the findings of a survey of the Association for the Defense of Consumer Rights on the family budget, families with more difficulty in coping with everyday expenses are those that have minor children, even if both spouses work.

“Half of these households live on less than a thousand euros per month, it is not difficult to assume that many of the workers elements only earn the national minimum wage (505 euros), or even less,” concludes the DECO.

The results of the statistical survey, to be published in the November issue of Money & Rights magazine, indicate that about two-thirds live with the weight of a housing loan, there are still those who have, or accumulate, loans for other purposes (buying car or furniture, for example).

Credit cards (37%) and store cards (26%) are also financial products that bring the respondents “tied” to pay interest, with three quarters of respondents to classify their situation as difficult or very difficult.

The study also concluded that “the state of household finances deteriorated in recent years, for many of these families.”

According to DECO, many of these families have trouble paying the bills, when not even unable to do, namely: electricity, gas, water, insurance (86%); rent or house loan (83%); other current expenses such as food, clothing and fuel (79%); education of the children (75%); loans for car purchase and / or other assets (73%); health care (62%).

More than half of respondents admitted have already paid bills after the deadline, although not always on a regular basis, and invoices that most times were outstanding were the communications (fixed and mobile telephone, television and Internet). Most had to reorganize the management of the family budget not to delay further payments, and in a third of cases are family loans or friends to solve the situation, reveals the survey.

Certain recurrent fees, such as vacation, insurance, car review or taxes, are taken care of by 71% of respondents also reveals the study, whereby a “nest egg” for that specific expense or wait for the holiday pay and / or Christmas solutions are used more frequently.

Other forms found by the Portuguese are to resort to savings and phasing the payment of bills.

In order to know how the Portuguese manage their family budget, between October and November 2014, the DECO sent a self-report questionnaire to a sample of 30 to 74, proportional to the population residing in Portugal in relation to variables gender, age and regions.

The same study was performed by DECO’s counterparts in Spain, Italy and Belgium. A total of 5649 replies, 1222 are the Portuguese.

Português

Português English

English