You want to know how infers? Finance show

- admin

- March 15, 2016

“New IRS 2015″ allows you to consult deductions related to health, housing and education. If you disagree you can claim

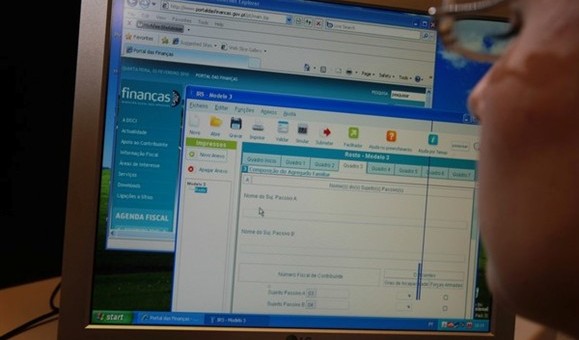

From today is available in the finance Portal “New IRS 2015,” the page created by the Tax Authority that allows taxpayers to consult all deductions in the areas of education, such as tuition fees, health – including user fees in public hospitals and health centers which were not available in e-invoice – homes and property, as interest payments to the bank or lace alugas homes. To these are general and restoration costs, for example, which had been validated by taxpayers.

In a statement, the Ministry of Finance explains that with this new link the taxpayer can access your individual deductions, values that do not take into account the household. This will only happen when filling out the IRS: the first delivery time is 1 to April 30. If you do not agree with the values can make a complaint to the end of the month, but the same does not have suspensive effect and therefore must meet the IRS completion deadlines.

To enter the site will have to authenticate, like you have to do to access the electronic or e-bill statements.

The statement will be pre-populated based on these values, but this year could still make changes and introduce expenses that are not being accounted for. But may only do so in expenses related to education, health, homes and housing. Other expenditure can no longer be changed.

Português

Português English

English